Gold Price Analysis: Chinese Yuan and Gold Remain in Lockstep

GOLD PRICE NEWS AND ANALYSIS

- Spot gold continues to slump as USDCNH drives the move.

- Gold support at $1,204 may hold.

GOLD PRICE ANALYSIS – CHINESE YUAN WEAKNESS CONTINUES TO HURT GOLD BULLS

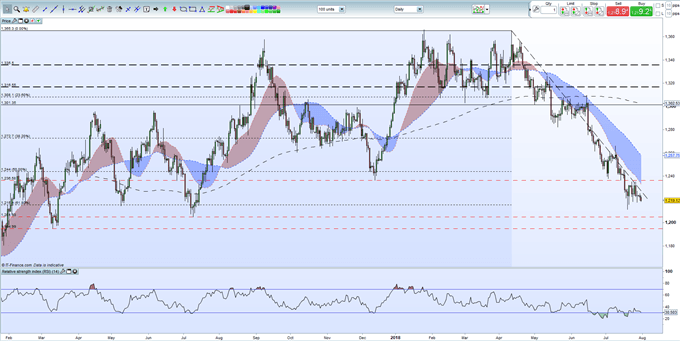

The price of gold has fallen nearly $150/oz. since touching a $1,365/oz. high just over three months ago as tightening US monetary policy and a weak offshore Chinese Yuan continue to hurt bullish gold investors. The CNH-gold correlation remains tight and is unlikely to be broken in the short-term, especially with tighter US monetary policy weighing on both asset classes. The Chinese Yuan is around 9% lower since US President Donald Trump ramped up trade tariff rhetoric, negating the overall effect of Trump’s tariffs on the Chinese economy. The ongoing US-China trade war will continue to be a driving force for both the Chinese Yuan and gold..

GOLD REMAINS STUCK IN A TECHNICAL DOWNTREND

We have noted before that gold is stuck in a downtrend started on April 11 when the precious metal traded at a high of $1,365/oz. The next level of support remains at $1,204/oz. and is likely to hold in the short-term and this roughly coincides with the politically sensitive USDCNH level of 7.00. USDCNH currently trades at 6.8400. If USDCNH holds below 7.00, gold may get a short-term boost, something that would please gold investors who remain overwhelmingly long of XAU.

SPOT GOLD (XAU) DAILY PRICE CHART (FEBRUARY 2017 – JULY 31, 2018)

Start Trading with Free $30 : CLAIM NOW $30

VERIFY YOUR ACCOUNT AND GET YOUR $30 INSTANTLY ,MAKE MONEY WITHDRAW !!

IF YOU FACE ANY PROBLEM TO GET THIS OFFER PLEASE CONTACT US FOR

SUPPORT , CLICK SMS BAR ABOVE THEN TALK TO US.

Comments

Post a Comment